rhenium (186Re) obisbemeda

A patented, targeted radiotherapeutic for brain and CNS cancers

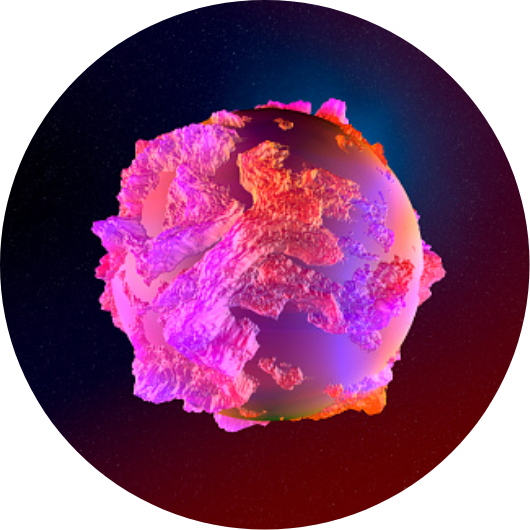

Comprised of a BMEDA-chelated Rhenium-186 radiation particle (beta/gamma emitter), encapsulated within a 100-nanometer nanoliposome

Currently being evaluated in U.S. Phase 1 clinical trials: ReSPECT-GBM (supported by NIH/NCI) for recurrent glioblastoma and ReSPECT-LM for leptomeningeal metastases